9+ loan against sblc

A non-recourse loan is a loan that the applicant doesnt need to pay back. It means SBLC financing or monetisation.

:max_bytes(150000):strip_icc()/iwruggia0098c-56a066735f9b58eba4b0445e.jpg)

Standby Letter Of Credit A Backup Plan For Payment

Standby Letter of Credit Monetization LTV.

. It must be remembered that a Standby Letter of Credit. On top of that top. This unique funding program provides an innovative path to project financing and offers borrowers the possibility of 100 financing.

Set up as a revolving line of credit an SBLOC allows you to borrow money using securities held in your investment accounts as collateral. In many cases it looks to. This is because the letter of credit clearly states the obligations of all parties that are involved in the transaction.

You can continue to trade and buy. The SBLC Transaction Project Funding Loan Program. If the BG or SBLC is leased then the client must present.

A financial standby letter of credit guards against these disputes. 10 to 49M Standby Letter of Credit SBLC 45 to 55 Non Recourse. Non Recourse Loan via bank instrument monetization is made possible by way of monetizing bank guarantee or standby letter of credit for cash or project funding.

10M to 49M Standby Letter of Credit SBLC - Owned -. Sblc Monetization is the process of converting a bank instruments such as Standby Letter of credit or Bank Guarantee into funds via loans or line of credit. We can purchase the Owned Standby Letter of Credit SBLC outright or allow the client to retain full ownership of it and create a Monetized Non-Recourse payment against the Owned Standby.

You will provide the BG SBLC LC or other banking instrument to Sandberg and we will serve as your lender. In other words obtaining loans and lines of credit using a Standby Letter of Credit as collateral. A standby letter of credit SBLCSLOC is a guarantee of payment by a bank on behalf of their client.

After that the monetizer can take over the SBLC paper and provide a non-recourse loan against it. MONETIZED LOANS BG SBLC NON-RECOURSE The Loan Monetization programs are for both leased and owned BG and SBLC. Our lending programs require a value of at least US 100 million to monetize.

SBLC monetisation Fast Loan Company International FLCI Limited Business Funding Solutions. This is a critical requirement of most Leased Standby Letter of Credit SBLC Issuers. 10M to 500M Leased Standby Letter of Credit 80 Recourse Loan with a Rated Bank instrument This loan has an interest between 2 75 per annum and can span up to ten years in length.

It is a loan of last resort in which the bank fulfills payment obligations by the end of the.

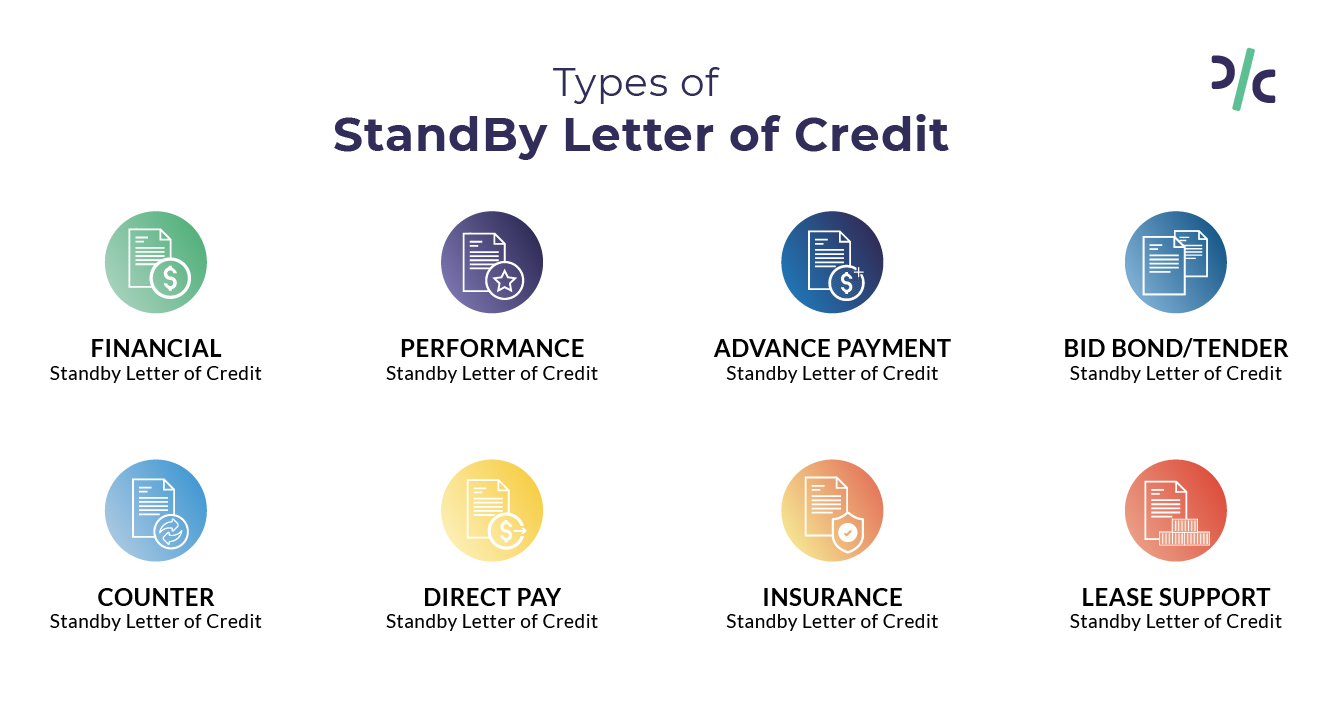

Sblc Standby Letter Of Credit Meaning The Complete Guide To Its Process

Sblc Or Standby Letter Of Credit

Sblc Or Standby Letter Of Credit

Sblc Or Standby Letter Of Credit

Sblc Bg Factsheet Know Everything About Standby Letter Of Credit Bank Guarantee Sblc Bg Providers Banking Procedure Monetizing Discounting Trade Trader Trading Finance Fund Loans Credit

How To Obtain A Standby Letter Of Credit Investment Nigeria

Sblc Standby Letter Of Credit Direct Providers No Upfront Charges Mt799 Mt760 Top Rated Eurozone Banks Tradefinance Trade Trader Trading Finance Banking Funding Lending Loans Credit Capital Assets Fintech Oilandgas Commodities Business

What Is The Difference Between Current Loans And Un Secured Loans Projectpro

Owned Standby Letter Of Credit Sblc Monetization The Hanson Group Of Companies

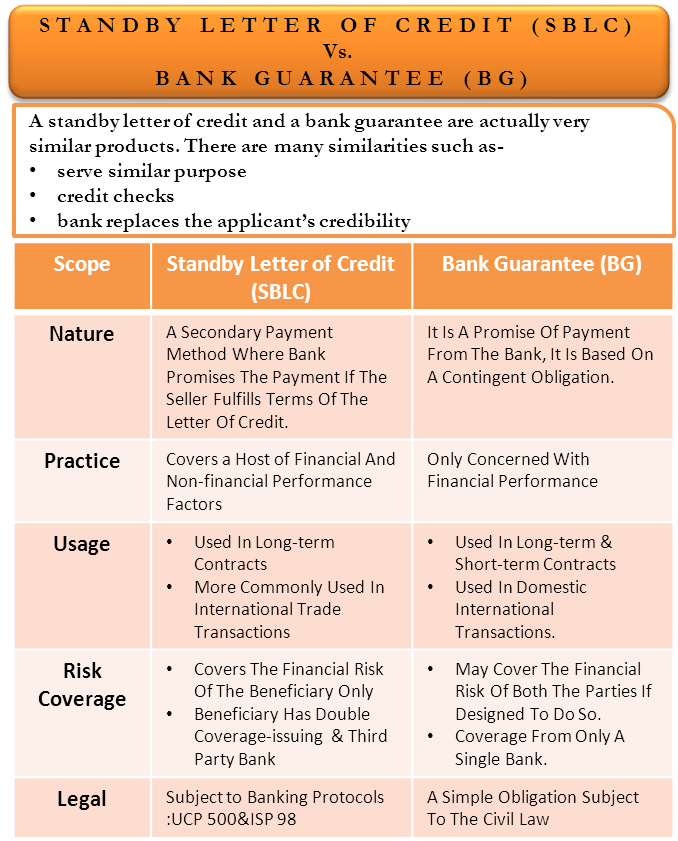

Standby Letter Of Credit Vs Bank Guarantee Differences Sblc Vs Bg

Sblc Standby Letter Of Credit Meaning The Complete Guide To Its Process

Buyers Credit Against Standby Letter Of Credit Sblc Bank Guarantee Buyer S Credit Supplier S Credit

Get Sblc For Loan Trade Finance Grand City Investment Ltd

The Major Difference Between Dlc And Sblc By Yiu Fung Finance Company Limited Issuu

Monetize Or Discount Sblc Bg Maximum Ltv Loan To Value Project And Trade Finance Ppp Trade Entry

What Is Sblc And How Does It Work Trade Finance Investing Money Accounting And Finance

Sblc Meaning Bg Sblc Provider Grand City Investment Ltd